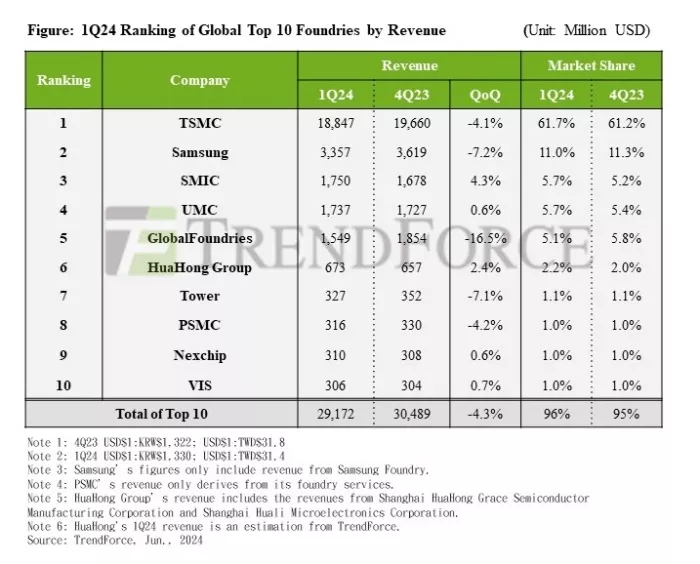

Top 10 Global Foundries at 4.3% QoQ Drop in 1Q24 Revenue as SMIC Climbed to 3rd Spot

June 12, 2024 -- As indicated by the survey of global market intelligence firm TrendForce, 1Q24 marked the entry of a traditional off-season for the consumer end, where the sporadic appearance of urgent orders within the supply chain were mostly replenishment of inventory among individual clients, and exhibited sluggishness in momentum on the whole. Simultaneously, automotive and industrial equipment applications have been receiving ongoing revisions in forecast under escalating economic risks, including inflation, geopolitical conflicts, and energy shortages. AI servers, attributed to the extensive CapEx input and competitions among major global CSPs, as well as the establishment of LLMs (Large Language Models) between enterprises, became the sole support for the supply chain throughout 1Q24. On account of aforementioned factors, the top 10 global foundries generated a total revenue of US$29.2 billion at a QoQ drop of 4.3% in 1Q24.

The top five foundries had been altered evidently in ranking. SMIC, having benefitted from obtaining orders of inventory replenishment for consumer products, together with the tendency of localized production, climbed to the third spot after overtaking GlobalFoundries and UMC. GlobalFoundries, due to repercussions from the revision of businesses related to automobile, industrial equipment and traditional data centers, fell to the fifth spot.

Despite strong demand for AI-related HPCs, TSMC had subsided in 1Q24 revenue to US$18.85 billion at an approximate QoQ drop of 4.1% due to the off season for stocking activities on consumer products such as smartphones and NBs, and was able to maintain a market share of 61.7% as other competitors were also subject to challenges derived from the off season. Apple’s initiation of its stocking cycle, as well as the steady and ongoing demand for HPCs related to AI servers, could actuate a single-digit QoQ growth in TSMC’s revenue during 2Q24.

Similarly, Samsung Foundry, who had sustained the impact of the off season for smartphones, as well as the tendency of localized production for Chinese Android smartphone brands and suppliers of peripherals, saw enervation in dynamics for its advanced nodes and peripheral ICs, and had thus generated US$3.36 billion of revenue at a QoQ drop of 7.2% in 1Q24, with a market share maintained at 11%. Despite expected reactivation of stocking for the smartphone market in 2Q24, TrendForce’s survey indicates excessive stocking activities from the client end in 1Q24, which led to a worse-than-expected performance in production for 2Q24. Samsung Foundry’s overall operation could be confined as a result, and may either level or achieve a slight QoQ increase in revenue, considering how Apple’s market share in China is likely to be carved up by Chinese brands on a continual basis, and that Samsung’s 5/4nm and 3nm advanced nodes are enervated in capacity utilization from a lack of large-scale clients.

Attributed to the tendency of localized IC production, as well as demand for order pulls on peripheral ICs of OLED DDI and CIS for new Chinese smartphones, SMIC generated US$1.75 billion of revenue in 1Q24 at a QoQ growth of 4.3% that is a better performance compared to its counterparts, and surged to the third spot in market share at 5.7% after overtaking GlobalFoundries and UMC. The 618 mid-year shopping festival that would contribute urgent orders of smartphones and consumer electronics in the supply chain will somewhat bump up SMIC’s capacity utilization of 8-inch and 12-inch wafers in 2Q24 compared to that of 1Q24, which although partially offsets its reduction of ASP, will result in a single-digit QoQ growth in revenue, and is likely to place the foundry at third place in terms of market share.

UMC’s small QoQ increase of 4.5% in shipment during 1Q24 had largely offset its reduction of annual ASP, and generated US$1.74 billion of revenue at a mere QoQ growth of 0.6%, with a market share of 5.7%. GlobalFoundries saw a QoQ drop of 16% in wafer shipment during 1Q24 at the expense of unhalted revisions of automotive, industrial equipment, and traditional data center orders, as well as the off season of order pulls for the smartphone supply chain. GlobalFoundries thus dropped to US$1.55 billion in revenue, followed by a diminishment in market share to 5.1%.

Tier 2 Foundries Involved in Slow Revitalization, Fierce Price Competitions, and Distinctive Operational Differences

HuaHong Group had rejuvenated in both shipment and capacity utilization in 1Q24, which although partially made up for its reduction of ASP, managed to generate a revenue of US$673 million at a QoQ growth of 2.4%, with a market share of 2.2%. Tower, despite subtle QoQ improvement in overall capacity utilization during 1Q24, had dropped in ASP due to its alteration of shipment mix, and thus generated US$327 million of revenue at a QoQ drop of 7.1%, with a market share of 1.1%.

PSMC saw an improvement in capacity utilization for 12-inch wafers during 1Q24 under revitalized wafer output, though the foundry, taking into account how most of its memory clients are focused on low-priced specialty DRAM, was inhibited in prices despite existence of rush orders for logic products, and had thus slid to a revenue of US$316 million at a QoQ drop of 4.2%. Nexchip generated US$310 million of revenue from 1Q24 at a largely leveled performance to that of 4Q23, and was ranked at ninth place in market share at about 1.0%. VIS dropped by an approximate QoQ of 4% in wafer shipment during 1Q24, which was mostly offset by its one-off recognition of LTA income, and generated US$306 million in revenue that was somewhat leveled to that of 4Q23, with a market share of 1.0%.

TrendForce is projecting a mere low single-digit QoQ growth in revenue among the top 10 global foundries for 2Q24 as the supply chain has been receiving successive urgent orders of corresponding applications in accordance with China’s mid-year shopping festival, and the imminent stocking period for new smartphones in 2H24, as well as the persistently robust demand for AI-related HPCs and peripheral ICs, despite slow resuscitation in mature nodes due to general economic risks, and unfavorable factors that include China’s sluggish market status and fierce price competitions.

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Related Chiplet

- Interconnect Chiplet

- 12nm EURYTION RFK1 - UCIe SP based Ka-Ku Band Chiplet Transceiver

- Bridglets

- Automotive AI Accelerator

- Direct Chiplet Interface

Related News

- Top 10 Foundries Experience 7.9% QoQ Growth in 3Q23, with a Continued Upward Trend Predicted for Q4

- Top 10 OSAT Companies of 2024 Revealed—China Players See Double-Digit Growth, Reshaping the Global Market Landscape, Says TrendForce

- Top 10 IC Design Houses’ Combined Revenue Grows 12% in 2023, NVIDIA Takes Lead for the First Time, Says TrendForce

- Manufacturers Anticipate Completion of NVIDIA's HBM3e Verification by 1Q24; HBM4 Expected to Launch in 2026

Latest News

- Cadence Launches Partner Ecosystem to Accelerate Chiplet Time to Market

- Ambiq and Bravechip Cut Smart Ring Costs by 85% with New Edge AI Chiplet

- TI accelerates the shift toward autonomous vehicles with expanded automotive portfolio

- Where co-packaged optics (CPO) technology stands in 2026

- Qualcomm Completes Acquisition of Alphawave Semi