Top 10 OSAT Companies of 2024 Revealed—China Players See Double-Digit Growth, Reshaping the Global Market Landscape, Says TrendForce

May 13, 2025 -- TrendForce’s latest report on the semiconductor packaging and testing (OSAT) sector reveals that the global OSAT industry in 2024 faced dual challenges from accelerating technological advancements and ongoing industry consolidation. While ASE holdings and Amkor maintained leading positions, OSAT providers from China, such as JCET and HT-Tech, saw strong double-digit revenue growth—supported by government policies and domestic demand—posing a growing challenge to the existing market order.

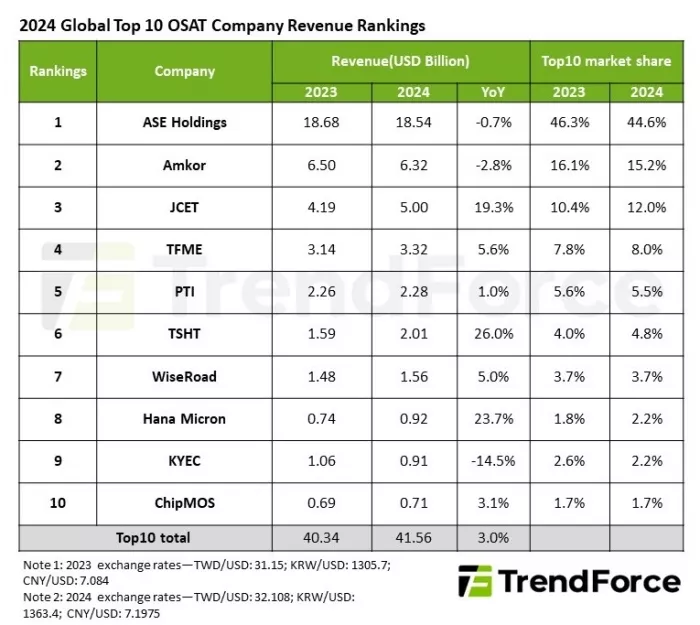

TrendForce reports that the combined revenue of the world’s top 10 OSAT companies reached US$41.56B in 2024, up 3% YoY. ASE led the ranking with revenue of $18.54B, holding nearly a 45% share among the top ten. However, sluggish recovery across smartphones, consumer electronics, automotive, and industrial sectors curbed packaging order growth. In testing, the company also faced intensified competition and the rise of in-house testing among some clients.

Amkor ranked second with $6.32B in revenue (-2.8% YoY), mainly due to lingering inventory corrections in the automotive segment and sluggish global vehicle sales. Although consumer electronics orders began to recover, intensified pricing pressure in China and Southeast Asia constrained revenue growth.

JCET took third place with $5B in revenue (+19.3% YoY). Demand for consumer electronics improved as semiconductor inventories began clearing in late 2023. The ramp-up of new platforms in AI PCs and mid-range smartphones helped JCET quickly fill capacity for standard packaging services.

Fourth-ranked Tongfu Microelectronics recorded $3.32B in revenue (+5.6% YoY), buoyed by a rebound in demand for communications and consumer electronics. A strong performance from key customer AMD also supported revenue stability.

Powertech Technology came in fifth with $2.28B in revenue (+1% YoY). Growth was limited by the absence of a significant rebound in memory packaging/testing and the ongoing transition phase in advanced packaging.

HT-Tech secured sixth place with $2.01B in revenue (+26% YoY), with the highest annual growth among the top ten OSATs. The company not only mass-produces low- and mid-end packaging but is also investing in high-end development, focusing on applications such as AI, HPC, automotive electronics, and memory, with a strong local customer base in China.

WiseRoad ranked seventh with $1.56B in revenue (+5% YoY). Growth was driven by recovering semiconductor demand and technological upgrades. Additionally, the retreat of some foreign competitors due to the U.S.-China tech conflict has allowed TFME to expand its domestic footprint.

Hana Micron ranked eighth with $920M in revenue (+23.7% YoY), supported by strong performance from its memory customers.

KYEC came in ninth with $910M in revenue (-14.5% YoY) mainly due to the sale of its subsidiary KLTech. That said, growing demand from AI servers and HPC chips continues to support KYEC’s testing business, alongside growing CoWoS testing demand.

ChipMOS rounded out the top ten with $710M in revenue (+3.1% YoY), with its driver IC business benefiting from steady demand in the automotive and OLED sectors.

TrendForce reports that the 2024 OSAT market reflects an ongoing restructuring of the semiconductor value chain. OSAT providers are facing increasingly stringent technological requirements from heterogeneous integration and wafer-level packaging (WLP) to die stacking, the adoption of advanced test equipment, and surging demand for high-frequency, high-density packaging driven by AI and edge computing. The industry is evolving from a traditional manufacturing model with a core strategic sector centered on advanced integration and R&D.

In summary, the global OSAT market in 2024 is defined by a dual dynamic: stable leadership from mature players and the rapid rise of regional challengers. This trend sets the state for intensified competition in next-generation technologies such as advanced packaging and heterogeneous integration.

Related Chiplet

- Interconnect Chiplet

- 12nm EURYTION RFK1 - UCIe SP based Ka-Ku Band Chiplet Transceiver

- Bridglets

- Automotive AI Accelerator

- Direct Chiplet Interface

Related News

- Top 10 Foundries Experience 7.9% QoQ Growth in 3Q23, with a Continued Upward Trend Predicted for Q4

- Top 10 IC Design Houses’ Combined Revenue Grows 12% in 2023, NVIDIA Takes Lead for the First Time, Says TrendForce

- Top 10 Global Foundries at 4.3% QoQ Drop in 1Q24 Revenue as SMIC Climbed to 3rd Spot

- CoWoS Drives Demand for Advanced Packaging Equipment; Sales Expected to Surpass 10% Growth in 2024

Latest News

- Cadence Launches Partner Ecosystem to Accelerate Chiplet Time to Market

- Ambiq and Bravechip Cut Smart Ring Costs by 85% with New Edge AI Chiplet

- TI accelerates the shift toward autonomous vehicles with expanded automotive portfolio

- Where co-packaged optics (CPO) technology stands in 2026

- Qualcomm Completes Acquisition of Alphawave Semi