SEMI Reports Global 300mm Fab Equipment Spending Expected to Total $374 Billion Over Next Three Years

SEMICON West – PHOENIX — October 8, 2025 — Global 300mm fab equipment spending is expected to reach $374 billion from 2026 to 2028, SEMI reported today in its latest 300mm Fab Outlook. This robust investment reflects fab regionalization and surging AI chip demand for data centers and edge devices, while underscoring the growing commitment to semiconductor self-sufficiency across key regions through localized industrial ecosystems and supply chain restructuring.

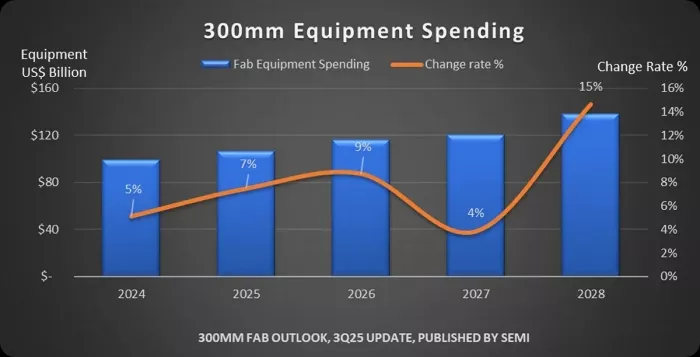

Worldwide 300mm fab equipment spending is expected to surpass $100 billion for the first time in 2025, growing 7% to $107 billion. The report projects investment will increase 9% to $116 billion in 2026, 4% to $120 billion in 2027, and 15% to $138 billion in 2028.

“The semiconductor industry is entering a pivotal era of transformation, driven by unprecedented demand for AI-enabled technologies and a renewed focus on regional self-sufficiency,” said Ajit Manocha, President and CEO of SEMI. “Strategic global investments and collaboration are driving robust, advanced supply chains and faster deployment of next-generation semiconductor manufacturing technologies. The global expansion of 300mm fabs will enable progress in data centers, edge devices, and the digital economy.”

Segment Growth

The Logic & Micro segment is projected to lead equipment expansion with $175 billion in total investments from 2026 to 2028. Foundries are expected to be the primary drivers of this growth, fueled by sub-2nm capacity build-outs. Key enablers include advanced technologies such as gate-all-around (GAA) architecture and backside power delivery, which are essential to enhancing chip performance and power efficiency for increasingly demanding AI workloads. More advanced 1.4nm process technology is expected to enter volume production by 2028-2029. Additionally, AI performance improvements are anticipated to drive massive growth in edge-devices including automotive electronics, IoT applications, and robotics. Beyond advanced processes, demand across all nodes and various electronics devices is expected to surge significantly, fueling mature process equipment investment.

The Memory segment is projected to rank second with $136 billion in spending over the three-year period, marking the beginning of a new growth cycle for the segment. DRAM-related equipment investment is expected to exceed $79 billion from 2026 to 2028, with 3D NAND investment reaching $56 billion over the same period. AI training and inference have driven comprehensive demand increases across various types of memory. AI training requires greater data transmission bandwidth and extremely low latency, significantly boosting high bandwidth memory (HBM) demand. Moreover, model inference generates higher quality and more diverse AI digital content, creating substantial demand for end storage capacity and driving 3D NAND Flash requirements. This robust demand has sustained elevated levels of supply chain investment in memory over the medium to long term, helping to mitigate potential downturns from traditional memory cycle fluctuations.

Analog-related segments’ anticipated investment is projected to exceed $41 billion over the next three years.

Including Compound semiconductors, the power-related segment is expected to invest $27 billion from 2026 to 2028.

Regional Growth

China is expected to continue to lead in 300mm equipment spending with $94 billion in projected investments from 2026 to 2028, sustained by national self-sufficiency policies.

Korea is projected to rank second in global 300mm equipment spending over the three-year period with $86 billion invested, supporting industries worldwide in generative AI demand.

Taiwan is expected to invest $75 billion in 300mm equipment over the three years, ranking third. Investment will concentrate primarily on 2nm and sub-2nm capacity to maintain dominance in advanced foundry capacity and technology leadership.

The report projects Americas to invest $60 billion from 2026 to 2028, rising to fourth position. U.S. suppliers are expanding advanced process capacity to meet surging AI application demands while catalyzing domestic industrial and investment upgrades to maintain global technology development leadership.

Japan, Europe & Middle East, and Southeast Asia are projected to invest $32 billion, $14 billion, and $12 billion, respectively, over the three-year period. Policy incentives aimed at alleviating critical semiconductor supply concerns are expected to increase equipment investment by more than 60% in these regions by 2028 compared to 2024.

Part of the SEMI Fab Forecast database, the SEMI 300mm Fab Outlook lists 391 facilities and lines globally. The report reflects 173 updates and nine new fabs/lines projects since its last publication in January 2025.

For more information on the report or to subscribe to SEMI market data, visit SEMI Market Data or contact the SEMI Market Intelligence Team (MIT) at mktstats@semi.org.

About SEMI

SEMI® is the global industry association connecting over 3,000 member companies and 1.5 million professionals worldwide across the semiconductor and electronics design and manufacturing supply chain. We accelerate member collaboration on solutions to top industry challenges through Advocacy, Workforce Development, Sustainability, Supply Chain Management and other programs. Our SEMICON® expositions and events, technology communities, standards and market intelligence help advance our members’ business growth and innovations in design, devices, equipment, materials, services and software, enabling smarter, faster, more secure electronics. Visit www.semi.org to learn more.

Related Chiplet

- Interconnect Chiplet

- 12nm EURYTION RFK1 - UCIe SP based Ka-Ku Band Chiplet Transceiver

- Bridglets

- Automotive AI Accelerator

- Direct Chiplet Interface

Related News

- Global Semiconductor Industry Plans to Invest $400 Billion in 300mm Fab Equipment Over Next Three Years, SEMI Reports

- Global Fab Equipment Investment Expected to Reach $110 Billion in 2025

- Global Semiconductor Fab Capacity Projected to Expand 6% in 2024 and 7% in 2025, SEMI Reports

- Global Semiconductor Equipment Billings Surged to $117 Billion in 2024, SEMI Reports

Latest News

- Qualcomm Completes Acquisition of Alphawave Semi

- Cadence Tapes Out UCIe IP Solution at 64G Speeds on TSMC N3P Technology

- Avnet ASIC and Bar-Ilan University Launch Innovation Center for Next Generation Chiplets

- SEMIFIVE Strengthens AI ASIC Market Position Through IPO “Targeting Global Markets with Advanced-nodes, Large-Die Designs, and 3D-IC Technologies”

- FormFactor Expands Silicon Photonics Test Capabilities With Acquisition of Keystone Photonics