Global Semiconductor Fab Capacity Projected to Expand 6% in 2024 and 7% in 2025, SEMI Reports

Global Semiconductor Fab Capacity Projected to Expand 6% in 2024 and 7% in 2025, SEMI Reports

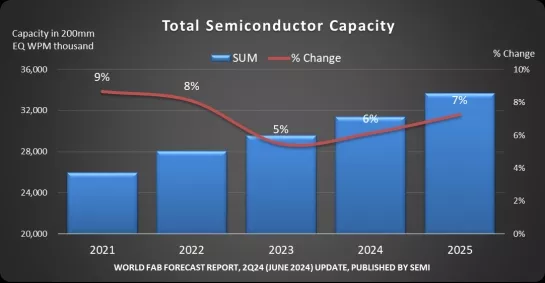

MILPITAS, Calif. – June 18, 2024 – To keep pace with unremitting growth in demand for chips, the global semiconductor manufacturing industry is expected to increase capacity by 6% in 2024 and post a 7% gain in 2025, reaching a record capacity high of 33.7 million wafers per month (wpm: 8-inch equivalent), SEMI announced today in its latest quarterly World Fab Forecast report.

Leading-edge capacity for 5nm nodes and under is expected to grow 13% in 2024, chiefly driven by generative artificial intelligence (AI) for data center training, inference, and leading-edge devices. To increase processing power efficiency, chipmakers including Intel, Samsung, and TSMC are poised to start production of 2nm Gate-All-Around (GAA) chips, boosting total leading-edge capacity growth by 17% in 2025.

“The proliferation of AI processing, from cloud computing to edge devices, is fueling the race to develop high-performance chips and driving a robust expansion of global semiconductor manufacturing capacity,” said Ajit Manocha, SEMI president and CEO. “This creates a virtuous cycle: AI will drive the growth of semiconductor content across a diverse range of applications, which in turn encourages further investment.”

Capacity Expansion by Region

Chinese chipmakers are expected to maintain double-digit capacity growth, registering a 14% increase to 10.1 million wpm in 2025 – nearly a third of the industry’s total – after logging a 15% rise to 8.85 million wpm in 2024. Despite the potential risks of an overshoot, the region continues aggressive investment in its capacity expansion, in part to mitigate the impact of recent export controls. Major foundry suppliers including Huahong Group, Nexchip, Sien Integrated and SMIC and DRAM maker CXMT are investing heavily to grow the region’s semiconductor manufacturing capacity.

Most of the other major chipmaking regions are expected to see capacity growth of no more than 5% in 2025. Taiwan is forecast to rank second in capacity in 2025 at 5.8 million wpm, a 4% growth rate, while South Korea is projected to take the third spot next year, expanding capacity 7% to 5.4 million wpm after surpassing the 5 million wpm mark for the first time in 2024. Japan, the Americas, Europe & Mideast, and Southeast Asia are expected to grow semiconductor manufacturing capacity 4.7 million wpm (3% YoY), 3.2 million wpm (5% YoY), 2.7 million wpm (4% YoY), and 1.8 million wpm (4% YoY), respectively.

Capacity Expansion by Segment

Fueled largely by Intel’s establishment of its foundry business and China’s capacity expansion, the foundry segment is projected to increase capacity 11% in 2024 and 10% in 2025, reaching 12.7 million wpm by 2026.

Rapid adoption of high bandwidth memory (HBM) to meet rising demand for faster processors required by AI servers is powering unprecedented capacity growth in the memory sector. Exploding AI adoption has driven increasing demand for denser HBM stacks, with each stack now integrating 8 to 12 dice. In response, leading DRAM makers are increasing investment in HBM/DRAM. DRAM capacity is expected to increase by 9% in both 2024 and 2025. By contrast, the 3D NAND market recovery remains slow, with no growth in capacity forecast for 2024 and a 5% increase expected in 2025.

The rise of AI applications in edge devices is expected to increase DRAM content in mainstream smartphones from 8GB to 12GB, while laptops using AI assistants will need at least 16GB of DRAM. The expansion of AI to edge devices will also stoke demand for DRAM.

Download a sample of the SEMI World Fab Forecast report.

For details about SEMI reports on other semiconductor sectors, visit SEMI Market Data or contact the SEMI Market Intelligence Team (MIT) at mktstats@semi.org.

About SEMI

SEMI® is the global industry association connecting over 3,000 member companies and 1.5 million professionals worldwide across the semiconductor and electronics design and manufacturing supply chain. We accelerate member collaboration on solutions to top industry challenges through Advocacy, Workforce Development, Sustainability, Supply Chain Management and other programs. Our SEMICON® expositions and events, technology communities, standards and market intelligence help advance our members’ business growth and innovations in design, devices, equipment, materials, services and software, enabling smarter, faster, more secure electronics. Visit www.semi.org to learn more.

Related Chiplet

- Interconnect Chiplet

- 12nm EURYTION RFK1 - UCIe SP based Ka-Ku Band Chiplet Transceiver

- Bridglets

- Automotive AI Accelerator

- Direct Chiplet Interface

Related News

- Gartner Forecasts Worldwide Semiconductor Revenue to Grow 17% in 2024

- Empower Semiconductor to Present at Chiplet Summit 2024 on Eliminating External Regulators in Chiplet Architectures

- Empower Semiconductor Showcases High-Density Power Chiplets and Embedded Integrated Voltage Regulators at APEC 2024

- Demand for NVIDIA’s Blackwell Platform Expected to Boost TSMC’s CoWoS Total Capacity by Over 150% in 2024

Latest News

- Where co-packaged optics (CPO) technology stands in 2026

- Qualcomm Completes Acquisition of Alphawave Semi

- Cadence Tapes Out UCIe IP Solution at 64G Speeds on TSMC N3P Technology

- Avnet ASIC and Bar-Ilan University Launch Innovation Center for Next Generation Chiplets

- SEMIFIVE Strengthens AI ASIC Market Position Through IPO “Targeting Global Markets with Advanced-nodes, Large-Die Designs, and 3D-IC Technologies”