Chiplets Market to Reach USD 107.0 Billion by 2033; Amid Rising Demand for Advanced Semiconductor Solutions

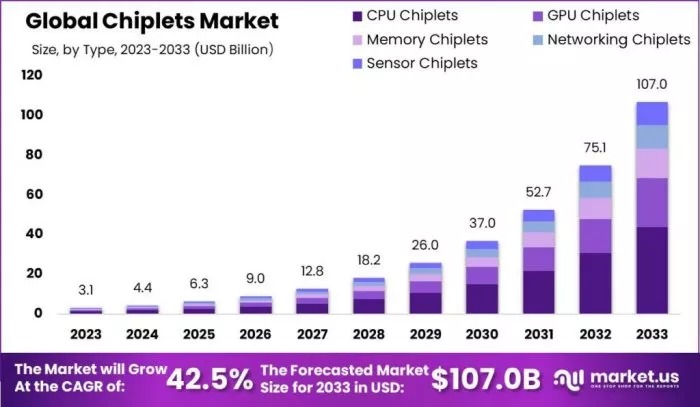

New York, Jan. 17, 2024 -- "According to Market.us, The Global Chiplets Market size is expected to be worth around USD 107.0 Billion by 2033 from USD 3.1 Billion in 2023, growing at a CAGR of 42.5% during the forecast period from 2024 to 2033."

Chiplets are discrete semiconductor components or functional blocks that can be integrated into a larger chip or system. The chiplets market encompasses the providers of these specialized components and the companies that integrate them into their designs.

The chiplets market refers to the industry segment that focuses on the design, development, and integration of chiplets into electronic systems. Chiplets are individual semiconductor components or functional blocks that can be combined to create a larger system or integrated into an existing chip. This market encompasses chiplet providers, system integrators, and companies involved in chiplet-based design and manufacturing.

Learn about additional key drivers, trends, and challenges available with Market.us. Read Sample Report Now @ https://market.us/report/chiplets-market/request-sample/

Analyst viewpoint

From an analyst's perspective, the chiplets market is poised for significant growth, driven by compelling factors and presenting numerous opportunities. The key driving force is the escalating demand for high-performance, energy-efficient computing in sectors such as consumer electronics, data centers, and automotive industries. Chiplets offer a strategic solution to the limitations of traditional monolithic chip architectures, especially as these industries push towards greater computational power and miniaturization. The modular nature of chiplets, which allows for the integration of various semiconductor technologies, is critical in enhancing performance and energy efficiency.

Opportunities within the chiplets market are abundant, especially in driving innovation for emerging technologies like artificial intelligence, 5G, and the Internet of Things (IoT). The adaptability of chiplets to specific applications paves the way for tailored solutions, fostering advancements in these areas. Furthermore, the growing need for standardization and interoperability among different chiplets components offers a unique opportunity for collaboration across the semiconductor industry. This collaboration could spur the development of a robust ecosystem, accelerating innovation and broadening the application scope of chiplets.

Key Takeaways

- The Chiplets Market is anticipated to reach USD 107.0 billion by 2033, with a projected steady Compound Annual Growth Rate (CAGR) of 42.5% over the next decade. In 2024, it is expected to reach USD 4.4 billion.

- In 2023, CPU Chiplets held the dominant market position, capturing over 41% of the market share, driven by high-performance computing demands.

- The Consumer Electronics segment dominated the market with over a 26% share in 2023, due to advancements in smartphones, laptops, and wearables.

- IT and Telecommunication Services held a dominant position in 2023, with more than a 24% share, driven by high-performance computing needs in data centers.

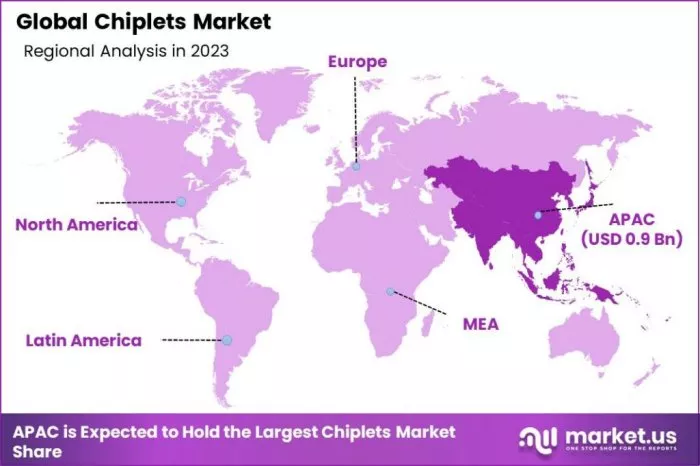

- In 2023, the Asia-Pacific (APAC) region emerged as a dominant force, capturing over 31% of the market share. This was attributed to advanced semiconductor manufacturing capabilities and rapid technological advancements in the region.

Build a Future-Proof Business! Buy our Premium Insights at Affordable Prices Now: https://market.us/purchase-report/?report_id=83992

Factors Affecting the Growth of the Chiplets Market

- Technological Advancements: The increasing complexity of semiconductor manufacturing, along with the limitations of traditional monolithic chip designs, is a significant driver. Chiplets technology, which allows for the integration of various microarchitectures on a single chip, addresses these complexities and limitations, thereby driving market growth.

- Demand for High-Performance Computing: There is a growing demand for high-performance computing across various sectors, including AI, data centers, automotive, and consumer electronics. This demand fuels the need for efficient, powerful, and smaller chips, which chiplets technology facilitates.

- Cost Effectiveness: The rising cost of advanced semiconductor manufacturing makes the chiplets approach more appealing. By allowing different components to be fabricated separately and then integrated, chiplets reduce manufacturing costs and the economic barriers to advanced chip development.

- Supply Chain Flexibility: The modular nature of chiplets offers greater flexibility in the supply chain. Companies can source different components from various suppliers, reducing dependency on a single source and mitigating supply chain risks.

- Standardization and Interoperability Challenges: The growth of the chiplets market is somewhat tempered by the need for standardization and interoperability among components from different manufacturers. Establishing industry-wide standards is crucial for the widespread adoption of chiplets.

- Research and Development (R&D) Investments: The amount of investment in R&D activities by key players in the semiconductor industry significantly impacts the growth of the chiplets market. Continuous innovation and development are essential for addressing technical challenges and expanding the capabilities of chiplets.

Want to Access the Statistical Data and Graphs, Request PDF Sample @ https://market.us/report/chiplets-market/request-sample/

Report Segmentation of the Chiplets Market

Type Analysis

In 2023, the CPU Chiplets segment held a dominant position in the market, capturing more than a 41.0% share. This dominance is largely attributed to the widespread use of CPU chiplets in high-performance computing applications, where their modular design allows for more efficient processing power. The flexibility of CPU chiplets in integrating with other types of chiplets, like GPU or memory chiplets, also contributes to their popularity. They serve as the core processing unit in many electronic devices, from personal computers to sophisticated data centers, driving the demand significantly.

The GPU Chiplets segment, on the other hand, has been gaining traction, especially in gaming, AI, and machine learning applications where high-end graphics and parallel processing capabilities are paramount. Memory Chiplets are also crucial, particularly in applications requiring large, fast memory pools, such as big data analytics and cloud computing.

Application Outlook

In 2023, the Consumer Electronics segment held a dominant position in the chiplets market, capturing more than a 26% share. This predominance is primarily due to the escalating demand for compact, high-performance electronic devices among consumers. The inherent ability of chiplets to enhance processing power while minimizing physical space aligns perfectly with the needs of smartphones, tablets, smartwatches, and other consumer electronics, which continually seek to balance power and size.

Following consumer electronics, the Data Centers segment also shows substantial growth, driven by the increasing data processing needs of cloud computing and big data analytics. Chiplets offer scalable and efficient solutions for these large-scale operations, making them ideal for data centers.

End-User Analysis

In 2023, the IT and Telecommunication Services segment held a dominant market position in the chiplets industry, capturing more than a 24% share. This segment's leadership is primarily due to the burgeoning demand for advanced telecommunications infrastructure and IT services, fueled by the global expansion of internet connectivity and the proliferation of cloud computing. Chiplets, with their ability to offer high performance and efficiency in data processing and transmission, are integral to meeting these demands. They enable the development of more powerful and energy-efficient servers, routers, and other telecommunications equipment, which are essential for handling the increasing data traffic and complex processing requirements of modern IT and telecommunication networks.

The Automotive sector follows closely, driven by the rapid advancements in electric and autonomous vehicles. These sophisticated automotive technologies require high-performance computing capabilities, which chiplets provide efficiently.

Don't miss out on business opportunities | Get sample pages at https://market.us/report/chiplets-market/request-sample/

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | US$ 3.1 Billion |

| Forecast Revenue 2033 | US$ 107.0 Billion |

| CAGR (2024 to 2033) | 42.5% |

| Asia-Pacific (APAC) Revenue Share | 31.0% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Key Market Segments

Type

- CPU Chiplets

- GPU Chiplets

- Memory Chiplets

- Networking Chiplets

- Sensor Chiplets

Application

- Consumer Electronics

- Data Centers

- Automotive

- Industrial

- Healthcare

- Other Applications

End-User

- Telecommunications

- IT and Telecommunication Services

- Automotive

- Healthcare and Life Sciences

- Consumer Electronics

- Other End-Users

Driving Factors:

- Modular Design and Scalability: Chiplets enable a modular approach to chip design, allowing designers to combine various specialized chiplets to create complex systems. This modular design provides scalability, as chiplets can be upgraded or replaced without redesigning the entire chip, resulting in cost savings and faster time-to-market.

- Performance and Functionality: Chiplets allow designers to leverage the most advanced process technologies for each functional block, optimizing performance and functionality. By integrating chiplets with different capabilities, designers can create highly efficient systems with improved power consumption, processing speed, and specialized functionalities.

- Cost and Yield Optimization: The use of chiplets enables better yield and cost optimization in semiconductor manufacturing. Instead of manufacturing a large monolithic chip, chiplets can be produced individually, increasing the yield as defects in one chiplet do not render the entire chip unusable. This approach reduces manufacturing costs and improves overall chip yield.

Opportunities:

- Customization and Flexibility: Chiplets offer opportunities for customization, allowing designers to tailor their systems for specific applications or customer requirements. With a range of chiplets available, designers can mix and match components to create highly specialized and differentiated products, catering to niche markets and customer demands.

- Collaboration and Ecosystem Development: The chiplets market provides opportunities for collaboration among chiplet providers, system integrators, and designers. Creating a robust ecosystem of chiplet providers and integrating their offerings into a unified platform encourages innovation, expands market reach, and fosters the development of new applications and solutions.

- Emerging Technologies and Applications: The rapid advancements in areas such as artificial intelligence, 5G, edge computing, and Internet of Things (IoT) present significant opportunities for chiplets. These technologies require specialized chiplets to handle specific functions, creating new markets and applications for chiplet integration.

Regional Analysis

In 2023, the Asia-Pacific (APAC) region held a dominant position in the chiplets market, capturing more than a 31% share. This dominance is largely attributed to the region's robust semiconductor manufacturing capabilities and the presence of key industry players in countries like China, South Korea, and Taiwan. The APAC region's rapid technological advancement and its significant investment in research and development further bolster its leading status. Additionally, the growing demand for consumer electronics, telecommunications infrastructure, and automotive technologies in APAC countries drives the region's chiplets market forward.

North America, particularly the United States, is another significant player in the chiplets market. The region's focus on innovative technologies, combined with substantial investments in the semiconductor industry, positions it as a key market for chiplets. North America's advanced IT infrastructure and the presence of leading tech companies also contribute to its substantial market share.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Top 10 Chiplets Market Key Players

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- JD.com, Inc.

- Walmart Inc.

- ULink AgriTech Pvt. Ltd.

- IndiaMART InterMESH Ltd.

- Rakuten Group, Inc.

- Etsy, Inc.

- Farmers Business Network, Inc.

- Tractor Supply Company

Recent Developments

- In August 2023, a collaboration between Google Cloud (US) and NVIDIA Corporation (US) was unveiled, aimed at providing advanced AI infrastructure and software. This partnership facilitates the deployment of large generative AI models and accelerates data science tasks through Google Cloud's NVIDIA-powered solutions

- Announced in June 2023, Intel Corporation (US) forged a partnership with Taiwan Semiconductor Manufacturing Company Limited (Taiwan) to manufacture chips catering to Intel's high-performance computing and graphics products. This collaboration is designed to mitigate Intel's dependence on external foundries.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Related Chiplet

- Interconnect Chiplet

- 12nm EURYTION RFK1 - UCIe SP based Ka-Ku Band Chiplet Transceiver

- Bridglets

- Automotive AI Accelerator

- Direct Chiplet Interface

Related News

- Innovation in the semiconductor market: chiplets pave the way to the future

- ACM Research Enters Fan-out Panel Level Packaging Market with Introduction of Ultra C vac-p Flux Cleaning Tool for Chiplets

- Glass, chiplets will propel advanced IC substrate market, says Yole

- Chiplets: A Technology, Not A Market

Latest News

- Where co-packaged optics (CPO) technology stands in 2026

- Qualcomm Completes Acquisition of Alphawave Semi

- Cadence Tapes Out UCIe IP Solution at 64G Speeds on TSMC N3P Technology

- Avnet ASIC and Bar-Ilan University Launch Innovation Center for Next Generation Chiplets

- SEMIFIVE Strengthens AI ASIC Market Position Through IPO “Targeting Global Markets with Advanced-nodes, Large-Die Designs, and 3D-IC Technologies”